Archived Content

In an effort to keep ICE.gov current, the archive contains content from a previous administration or is otherwise outdated. This information is archived and not reflective of current practice.

Dozens indicted in multimillion dollar Indian call center scam targeting US victims

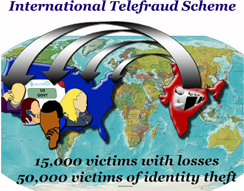

HOUSTON – Sixty-one individuals and entities have been charged via an indictment unsealed Thursday for their alleged involvement in a transnational criminal organization that victimized tens of thousands of people in the United States, resulting in hundreds of millions of dollars in losses. The Department of Homeland Security (DHS) Office of Inspector General (OIG), U.S. Immigration and Customs Enforcement’s (ICE) Homeland Security Investigations (HSI), and the U.S. Treasury Inspector General for Tax Administration (TIGTA) led the investigation.

In connection with the scheme, law enforcement arrested 20 individuals in the United States Thursday, and 32 individuals and five call centers in India were charged for their alleged involvement. An additional U.S.-based defendant is currently in the custody of ICE.

ax U.S. Attorney Kenneth Magidson, Assistant Attorney General Leslie R. Caldwell of the Justice Department’s Criminal Division, Executive Associate Director Peter T. Edge of HSI, Inspector General J. Russell George of TIGTA and Inspector General John Roth of the DHS OIG made the announcement today.

“This indictment will serve to not only seek the conviction of those involved, but will send a message around the world that no one is safe from prosecution for participating in such pervasive transnational fraud schemes,” said Magidson. “We are extremely vigilant when the names of U.S. government agencies are used to perpetuate fraud for the purpose of victimizing so many innocent American citizens.”

“The indictment we unsealed and the arrests we made today demonstrate the Justice Department’s commitment to identifying and prosecuting the individuals behind these impersonation and telefraud schemes, who seek to profit by exploiting some of the most vulnerable members of our communities,” said Caldwell. “This is a transnational problem, and demonstrates that modern criminals target Americans both from inside our borders and from abroad. Only by working tirelessly to gather evidence, build cases, and working closely with foreign law enforcement partners to ensure there are no safe havens can we effectively address these threats.”

“Today’s actions will not only bring a sense of justice to the victims in this case, but this significant investigation will also help increase awareness of this type of fraud,” said Edge. “To potential victims, our message today is simple: U.S. government agencies do not make these types of calls, and if you receive one, contact law enforcement to report the suspected scam before you make a payment.”

“All agencies involved in today’s announcement are to be congratulated and commended on their outstanding efforts,” said George. “This indictment is the result of countless hours of solid investigative work and excellent cross-governmental collaboration concerning massive amounts of fraud that individuals have allegedly perpetrated on the American people.”

“This multi-agency, three year investigation illustrates the ability of federal, state and local agencies to successfully leverage resources, communicate and work together to achieve justice,” said Roth. “We commend the victims for overcoming any possible embarrassment or fear and coming forward and report this to the authorities.”

On Oct. 19, the indictment was returned by a grand jury in the U.S. District Court for the Southern District of Texas. It charges the defendants with conspiracy to commit identity theft, false personation of an officer of the United States, wire fraud and money laundering. One of the defendants is separately charged with passport fraud.

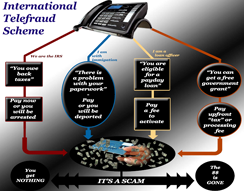

The indictment alleges that the defendants were involved in a sophisticated fraudulent scheme organized by conspirators in India, including a network of call centers in Ahmedabad, India. Using information obtained from data brokers and other sources, call center operators allegedly called potential victims while impersonating officials from the Internal Revenue Service (IRS) or U.S. Citizenship and Immigration Services. According to the indictment, the call center operators then threatened potential victims with arrest, imprisonment, fines or deportation if they did not pay taxes or penalties to the government. If the victims agreed to pay, the call centers would then immediately turn to a network of U.S.-based co-conspirators to liquidate and launder the extorted funds as quickly as possible by purchasing prepaid debit cards or through wire transfers. The prepaid debit cards were often registered using misappropriated personal identifying information of thousands of identity theft victims, and the wire transfers were directed by the criminal associates using fake names and fraudulent identifications.

The co-conspirators allegedly used “hawalas,” in which money is transferred internationally outside of the formal banking system, to direct the extorted funds to accounts belonging to U.S.-based individuals. According to the indictment, these individuals were expecting the hawala transfers but were not aware of the illicit nature of the funds. The co-conspirators also allegedly kept a percentage of the proceeds for themselves.

According to the indictment, one of the call centers extorted $12,300 from an 85-year-old victim from San Diego, California, after threatening her with arrest if she did not pay fictitious tax violations. On the same day she was extorted, one of the U.S.-based defendants allegedly used a reloadable debit card funded with the victim’s money to purchase money orders in Frisco.

The indictment also alleges the defendants extorted $136,000 from a victim in Hayward, California, who they called multiple times over a period of 20 days, fraudulently purporting to be IRS agents and demanding payment for alleged tax violations. The victim was then directed to purchase 276 stored value cards which the defendants then transferred to reloadable debit cards.

Some of the victim’s money ended up on cards which were activated using stolen personal identifying information from U.S.-based victims.

At times, the conspirators would allegedly use alternative fraudulent schemes where the call center operators would offer victims small short-term loans or advise them they were eligible for grants. The indictment alleges the conspirators would then request a good-faith deposit to show the victims’ ability to pay back the loan or fee payment to process the grant. The victims of the alleged scam never received any money after making the requested payment.

The following law enforcement agencies assisted with the investigation: Ft. Bend County Sheriff’s Department in Texas, the Hoffman Estates Police Department in Illinois, the Leonia Police Department in New Jersey, the Naperville Police Department in Illinois, the San Diego County District Attorney’s Office Family Protection/Elder Abuse Unit, the U.S. Secret Service, the U.S. Small Business Administration Office of Inspector General, the International Organized Crime Intelligence and Operations Center, Interpol Washington. U.S. Attorney’s Offices for the Northern District of Alabama, District of Arizona, Central District of California, Northern District of California, District of Colorado, Northern District of Florida, Middle District of Florida, Northern District of Illinois, Northern District of Indiana, District of Nevada and District of New Jersey provided significant support in this case.

The Federal Communications Commission’s Enforcement Bureau provided assistance in TIGTA’s investigation.

Assistant U.S. Attorneys S. Mark McIntyre and Craig Feazel are prosecuting the case along with Senior Trial Attorney Hope Olds and Trial Attorney Michael Sheckels of the Criminal Division’s Human Rights and Special Prosecutions Section and Trial Attorney Robert Stapleton of the Criminal Division’s Asset Forfeiture and Money Laundering Section.

A Department of Justice website has been established to provide information about the case to identified victims, potential victims and the public. Anyone who believes they may be a victim of fraud or identity theft in relation to this investigation or other telefraud scam phone calls may contact the Federal Trade Commission (FTC).

Anyone who wants additional information about telefraud scams generally, or preventing identity theft or fraudulent use of their identity information, may obtain helpful information on the IRS tax scams website, the FTC phone scam website and the FTC identity theft website.

An indictment is a formal accusation of criminal conduct, not evidence. A defendant is presumed innocent unless convicted through due process of law.