Archived Content

In an effort to keep ICE.gov current, the archive contains content from a previous administration or is otherwise outdated. This information is archived and not reflective of current practice.

ICE removes UK national convicted of violating FATCA

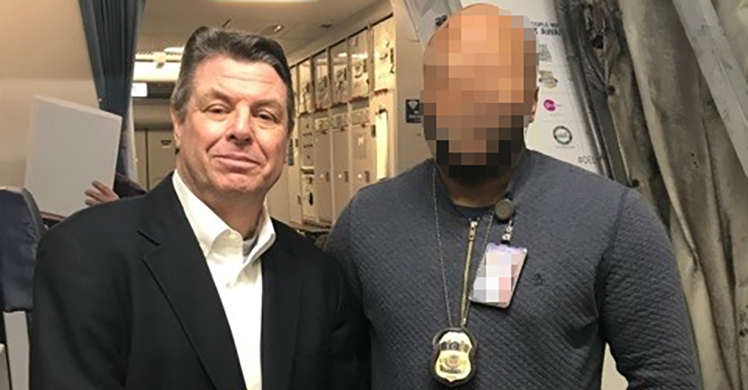

NEW YORK — A United Kingdom national, the first to be convicted of violating the Foreign Account Tax Compliance Act (FATCA) in the U.S., was removed to his home country Feb. 15 by U.S. Immigration and Customs Enforcement's (ICE) Enforcement and Removal Operations (ERO) deportation officers.

Adrian Paul Baron, 64, was removed to London, via a commercial flight from New York’s John F. Kennedy International Airport.

On March 20, 2018, Baron, the chief business officer and former chief executive officer of an offshore bank, was indicted in U.S. District Court-Eastern District of New York (EDNY) for conspiracy to defraud the United States by failing to comply with FATCA. In July 2018, Baron was arrested by Hungarian authorities and subsequently transported to the U.S. to stand trial. On Sept. 11, 2018, Baron pleaded guilty to conspiring to defraud the United States by failing to comply with FATCA, marking the first-ever conviction for failure to comply with the act. Additionally, as part of his guilty plea, Baron stipulated to a judicial removal order (JRO). On Jan. 24, 2019, Baron was sentenced to time served – receiving credit for time spent in Hungarian law enforcement custody, fined $25,000 (USD), and based on the JRO, ordered removed to the United Kingdom. On Jan. 25, 2019, Baron entered ICE custody so the agency could remove him from the U.S.

According to court documents, in June 2017, Baron met with an undercover agent posing as a U.S. citizen involved in stock manipulation schemes who was interested in opening corporate bank accounts at Loyal Bank. The undercover agent informed Baron that he did not want to appear on any documents for his bank accounts at Loyal Bank, even though he would be the true owner. Baron informed the undercover agent that Loyal Bank could accommodate that request and could also provide debit cards linked to any opened accounts. In July 2017, the undercover agent again met with Baron and described how his stock manipulation scheme operated and his need to circumvent the Internal Revenue Service’s reporting requirements under FATCA. During the meeting, Baron informed the undercover agent that Loyal Bank would not submit a FATCA declaration to regulators unless there was “obvious” U.S. involvement indicated. Subsequently, Loyal Bank opened multiple bank accounts for the undercover agent in July and August 2017. At no time did Baron or Loyal Bank request or collect FATCA Information from the undercover agent, as required by law.

FATCA is a federal law enacted in 2010 that requires foreign financial institutions to identify their U.S. customers and report information (FATCA Information) about financial accounts held by U.S. taxpayers either directly or through a foreign entity. FATCA’s primary aim is to prevent U.S. taxpayers from using foreign accounts to facilitate the commission of federal tax offenses.