Archived Content

In an effort to keep ICE.gov current, the archive contains content from a previous administration or is otherwise outdated. This information is archived and not reflective of current practice.

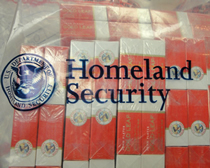

'Operation Smokeout' leads to seizure of thousands of untaxed cigarettes and criminal charges

NEW YORK - A three-month investigation led by U.S. Immigration and Customs Enforcement's (ICE) Homeland Security Investigations (HSI) into the smuggling of cigarettes from overseas through John F. Kennedy (JFK) International Airport has resulted in the arrest of a dozen individuals who have been charged with state tax violations and falsified business records.

In addition to the criminal charges, law enforcement authorities have seized more than 4,000 cartons of untaxed cigarettes, 22,000 untaxed cigars and nearly $400,000 in cash and property in the past three months. The investigation dubbed "Operation Smokeout" revealed the bootleg cigarettes and cigars were coming primarily from China, South Korea, Pakistan, Uzbekistan, Haiti and Guyana (Map of Distribution Network).

"This investigation targeted individuals who were bringing thousands of cigarettes from overseas with the intent of reselling them right here in New York City. No reporting, no taxes, no customs duties, just pure profit from the smuggler's perspective," said Mona Forman, deputy special agent in charge of ICE HSI in New York. "Cigarette smuggling can be a lucrative enterprise with the illicit proceeds used to fund other criminal behavior. We will continue to work with our law enforcement partners to dismantle organizations behind this illegal activity."

"Cigarette smuggling to evade state and local taxes is a multi-million dollar industry. It is a highly profitable tax-free cash business for those involved in it. However, it cheats taxpayers who must dip into their pockets to pay higher taxes," said Queens District Attorney Richard A. Brown, whose office is prosecuting the cases. "It cheats the government as well by fueling an underground economy which does not pay much needed State and City taxes. In today's cases, it is estimated that the twelve defendants shortchanged New York State and New York City out of approximately $270,000 in tax revenue."

All cigarette packages sold in New York City must bear a joint New York City/New York State tax stamp and only a licensed stamping agent can possess untaxed cigarettes and affix the tax stamp on the packages. The Queens District Attorney's office has formed a new unit specifically to investigate and prosecute those who violate the law by failing to pay any type of tax obligations - such as excise, sales and income - associated with legal and illegal activities including cigarette smuggling.

In one of the cases announced Thursday, it is alleged that Bobirjon S. Shakirov, 36, of Queens, arrived at JFK Airport from the Republic of Uzbekistan on April 3. He was carrying 170 cartons of cigarettes, which he did not declare on his customs declaration form or verbally mention to a U.S. Customs and Border Protection (CBP) officer. The tax value on those cigarettes is $10,982.

In another case, Kwang Soo Lee, 67, of Flushing, N.Y., is alleged to have received a package by U.S. mail on March 24 that was intercepted at the airport's international mail facility. The package was addressed to Eden Cleaners/Maggie Lim and contained 30 cartons of untaxed "Paran" brand Korean cigarettes with a tax value of $1,938. When the package was delivered to Lee, he signed for it and told the postman, who was in fact an undercover U.S. postal inspector, that he was not Maggie Lim but Maggie Kim.

Later that day, a search warrant was executed at Lee's residence and investigators allegedly observed an open box containing 30 cigarette cartons plus 11 additional cartons of Paran cigarettes with a tax value of $691. It is alleged that in statements made by Lee at the time of his arrest that the March 24 box of cigarettes was the third such delivery of cigarettes he had received in the last three months on behalf of a third party.

Since 2005, the Queens District Attorney's office has targeted tax evasion, revenue and financial crimes. These investigations have to date returned more than $5 million in revenue to New York state.

ICE HSI was joined in this investigation by CBP, U.S. Postal Inspection Service, the Queens District Attorney's office, the Port Authority Police and the New York State Department of Taxation and Finance.