COVID-19 Financial Fraud

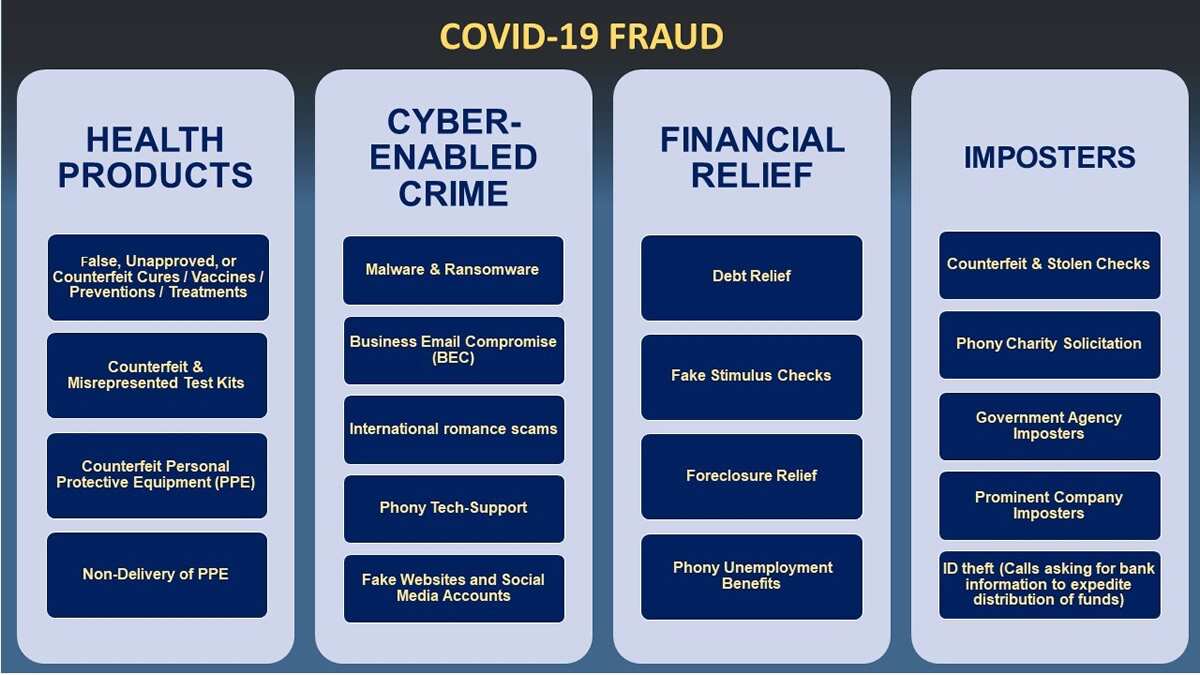

Scammers have attempted to profit from the COVID-19 pandemic through fraudulent financial activity relating to payment for non-existent or counterfeit goods (testing kits and medical treatments), fraudulent fundraising for phony charities, and other financial relief scams. Many COVID-19 fraud schemes target the elderly. The following infographic contains a list of consumer scams identified by federal law enforcement and regulatory agencies:

How You Can Help

INCREASE awareness by monitoring the impact of COVID-19 and related reporting

- Federal Trade Commission (FTC): Subscribe to alerts for consumers and businesses to keep up with the latest scams.

- The Financial Crimes Enforcement Network (FinCEN) has issued guidance to financial institutions in response to the COVID-19 pandemic at the following link.

MAINTAIN strong “Know Your Customer” practices and comply with the Bank Secrecy Act and other industry reporting requirements through a comprehensive anti-money laundering program

- The Financial Crimes Enforcement Network (FinCEN): Provides further information to financial institutions in response to the Coronavirus Disease 2019 (COVID-19) pandemic

STRENGTHEN communication and promote public-private partnerships

- Partner with your local HSI office by maintaining open lines of communication and report suspicious activity

REPORT SCAMS

- If you suspect you are being scammed, don’t hesitate in reporting the incident to local law enforcement and contact Homeland Security Investigations at Covid19Fraud@dhs.gov. Even if it’s too late to recoup losses, details may help others from becoming a victim.

Protecting America is more than just a responsibility for government agencies; it's a shared mission for all Americans. The importance of private sector partnership in this shared mission cannot be overstated. There are several ways individuals and businesses can help: